Discount of tax penalties is a practice based on the short and peaceful settlement of disputes at the administrative stage without resorting to judicial proceedings regarding the penalties imposed on taxpayers or tax responsible parties. The Revenue Administration (“RA”), which works to collect tax debts in order to increase tax revenues, has prepared an information brochure based on Article 376 of the Tax Procedure Law No. 213 (“TPL”) regarding the discounted payment of tax penalties by taxpayers and tax responsible parties. The “Tax Penalty Discount Brochure” has been updated within the scope of the amendments made by the Law dated 28/07/2024 and numbered 7524.

1. What is the Discount for Tax Penalties? It is a facility that allows the payment of the remaining amount by making a discount at certain rates on the tax loss penalty, irregularity, and special irregularity penalties on behalf of taxpayers or tax responsible and in the event that the conciliation is realized, it allows the payment of the remaining amount by making a discount at certain rates on the reconciled tax loss penalty.

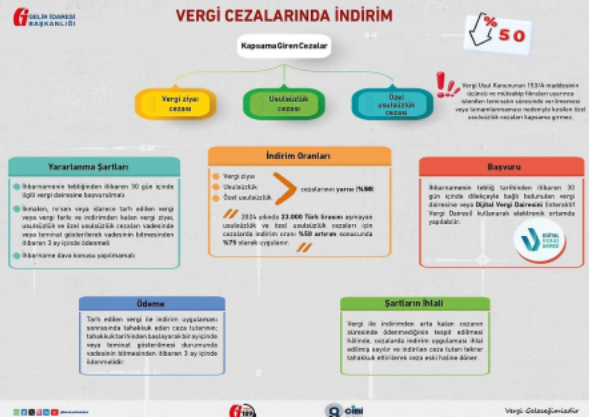

2. Which penalties are included in the scope of the Tax Penalty Discount?

Within the scope of the discount;

• Tax loss penalty,

• Irregularity fine,

• Special irregularity penalties are included.

3. Who can benefit from the discount of tax penalties?

Taxpayers or tax responsible parties may benefit from the discount.

4. What are the Conditions for Benefiting from the Discount on Tax Penalties?

From this application;

• Provided that the tax or tax difference that has been assessed by the tax assessor, ex officio or administration and, tax loss, irregularity and special irregularity penalties remaining from the discount are paid within 30 days from the notification date of the notice by applying to the relevant tax office with a petition (or through the interactive tax office) or within 3 months from the end of the due date by showing the type of collateral specified in Law No. 6183,

• In case of a conciliation, 75% of the agreed tax or tax difference and 75% of the tax loss penalty must be paid within the payment periods specified in the Law,

• Provided that the notice has not been subject to a lawsuit, it can be benefited.

5. What are the Discount Rates for Tax Penalties?

• Half (50%) of the Tax Loss, Irregularity and Special Irregularity Penalties applied on time,

• In the event of a conciliation, if the entire agreed tax or tax difference and 75% of the tax penalties are paid within the payment periods, 25% of the agreed penalty is discounted.

6. Can the Taxpayer Who Filed a Lawsuit Benefit from the Discount Application? Although a lawsuit is filed upon the notification of notice of the tax/penalty, it is possible to benefit from the discount in tax penalties if the tax lawsuit is abandoned before the thirty-day application period and before the tax court makes a decision. In case the lawsuit is abandoned after the expiration of the thirty-day application period following the notification of the notice, it is not possible to benefit from the discount in penalties.

7. Can a lawsuit be filed within the legal period after the tax discount request?

The taxpayer or the tax responsible may file a lawsuit by giving up the request for discount in tax penalties before the expiration of the thirty-day period starting from the notification date of the notice.

8. Can the taxpayer who has requested conciliation benefit from the discount? The taxpayer or tax responsible may request to benefit from the discount by giving up the conciliation request before the thirty-day application period from the date of notification of the notice or until the signing of the conciliation.

9. Is it possible to request conciliation within the legal period by giving up the tax discount request?

It is possible for taxpayers or tax responsibles to benefit from the conciliation by first requesting a discount for the taxes and penalties imposed on their behalf, and then declaring with a petition that they have given up these requests for the unpaid amounts within the thirty-day period following the notification date of the notice. However, it is not possible to benefit from the conciliation after benefiting from the discount application for the amounts in the notices issued and making payment.

10. Is there any possibility of a discount on the reconciled penalty in case the conciliation is realized?

With the amendment made in Article 376 of the TPL with the Law No. 7524, no further discount will be applied to the reconciled penalties as of 02/08/2024. The provisions of the previous law shall apply to the taxes and penalties for which conciliation has been requested before this date but the conciliation day has not yet been given, the conciliation day has been given but the conciliation meeting has not been held, or the conciliation day has been postponed or the conciliation request period has not expired.

11. What is the Discount Rate for Irregularity and Special Irregularity Penalties not exceeding 23.000 TL in 2024?

According to Additional Article 1 of the TPL amended by Law No. 7338, within the scope of conciliation after assessment, the discount rate will be applied as 75% for irregularity and special irregularity penalties that do not exceed 23.000 Turkish Liras in 2024. According to the regulation, in determining the irregularity and special irregularity penalties that can be subject to conciliation, the total amount of the penalty to be imposed on the basis of the act requiring the penalty will be taken into account.

12. When is the payment made after the discount of tax penalties?

The tax levied and the penalty amount accrued after the discount must be paid on due date (within one month starting from the date of accrual) or within 3 months from the end of the due date if the collateral of the type specified in Law No. 6183 is shown. In the event of a conciliation, if the conciliation report is notified to the person who may concern before the payment periods, the payment must be paid within the legal payment periods; if the conciliation report is notified after the payment periods have partially or completely passed, the overdue payments must be paid within one month from the notification of the conciliation report.

13. What should be done in case of non compliance with the conditions of tax penalty discount?

If it is determined that the tax accrued upon the request for discount in penalties and the penalty remaining after the discount is not paid in due time, the discount in penalties is deemed to have been violated and the discounted penalty amount is re-accrued. In order to benefit from the discount in penalties, the original tax and the remaining penalty after the discount must be paid. In addition, if the payment is not made within the 3- month period given due to the collateral, the period given is converted into a normal term. The collateral shown by the taxpayer is converted into money